A review of the Bank of England’s economic forecasting undertaken by the former chair of the U.S. Federal Reserve has found “significant shortcomings” that should be addressed to better inform future interest rate decisions

ByPAN PYLAS Associated Press

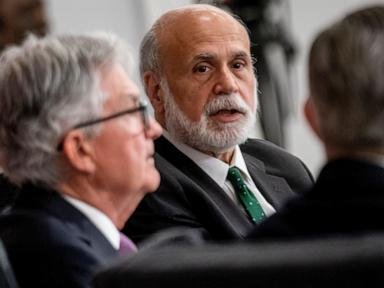

LONDON — A review of the Bank of England’s economic forecasting that was published Friday and undertaken by Ben Bernanke, the former chair of the U.S. Federal Reserve, has found “significant shortcomings” that should be addressed to better inform future interest rate decisions.

Following widespread criticism about the Bank of England’s forecasts, Bernanke was tasked last year to review the forecasting models.

Though noting that all central banks have had problems over the past few years as a result of a series of economic shocks, notably the coronavirus pandemic and the cost-of-living crisis heightened by Russia’s invasion of Ukraine, Bernanke said the Bank of England’s issues were made worse by out-of-date software that had not been properly maintained.

The review said that “insufficient resources have been devoted to ensuring that the software and models underlying the forecast are adequately maintained.”

Bernanke, who led the Fed between 2006 and 2014, a period that included the global financial crisis, made a series of recommendations that the Bank of England said it was committed to fulfilling.

Bank of England Gov. Andrew Bailey said the review was a “once-in-a-generation opportunity” for the central bank to update its models and make them fit for purpose to a ”more uncertain world.”

One recommendation is that the Bank of England start producing its own forecasts of what might happen to interest rates in future, something that could help inform its inflation forecasts.

Over the past couple of years, the Bank of England has faced criticism for being too slow to respond to surging inflation stoked by Russia’s invasion of Ukraine, which sent energy costs soaring, and supply issues connected to the lifting of COVID-19 restrictions.

As a result, critics have argued that inflation ended up rising higher than it should have done to a multidecade high of more than 11% — 2 percentage points more than in the U.S., for example.

The consequence of that, they say, is that the Bank of England’s rate-setting Monetary Policy Committee then had to rise interest rates by more than would otherwise have been required and will have to stay higher for longer. The bank’s main interest rate has been held at 5.25% since August.

Higher interest rates, which cool the economy by making it more expensive to borrow, thereby bearing down on spending, have contributed to easing inflation worldwide, though they also have affected economic activity. The British economy has barely grown over the past year, and few economists expect much of an uptick in 2024.